Is the Value Increasing or Decreasing?

Introduction

What do we need to know about investments and credit to make responsible decisions that meet our financial goals?

How might someone use different tools to help them understand how their investment or credit is changing over time?

Let’s find out together!

Investing

Investing is like saving, but it involves putting your money somewhere else to try and make more money. An investment is a product that people can buy from a financial institution that may grow in value.

When thinking about investments, someone might consider the following:

- Security: Is this investment stable or is there potential to lose money?

- Rate of return: What is the total amount of interest earned on the investment?

- Time: How long do I need to keep and/or pay into my investment?

Types of investments

Investing can help you to grow your money, but not all investments are created equal. Each type of investment comes with its own level of risk—some are relatively safe and stable, while others carry the potential for higher rewards but also higher chances of loss.

Let’s explore a few different types of investments.

Record your thoughts using a method of your choice.

Note: These are only a few examples of types of investments. Each financial institution will have its own investment options and a variety of rates of return.

Press the following tabs to learn more about different types of investments and the risks involved.

Stocks are shares or pieces of a public company that can be bought by an investor. They are an example of a very high-risk investment with a high rate of return. The money the investor makes on the stock depends on how that stock performs in the financial market. This means that if a stock performs poorly, an investor can lose money—but if it performs well, an investor can make more money than expected.

Bonds are an example of a medium-risk investment. Bonds are loans that investors give to a company or government with the promise of repayment and interest. Bonds usually allow you to get your money back plus interest. They have a lower rate of return than stocks and require the investor to keep the money they have invested in a bond for a specific amount of time without taking it out.

A mutual fund is a type of investment that is shared by many investors. Mutual funds are an example of a medium-risk investment. An investor will usually get their money back including interest on a mutual fund. Sometimes the financial institution will charge fees to manage the mutual fund.

A GIC (guaranteed investment certificate) is a savings certificate that gains interest and has a set time before the investor can withdraw their money. GICs are an example of a low-risk investment. An investor will always get their money back with interest. However, the rate of return is low, and an investor cannot access their money for a set amount of time.

Tax-free savings

A TFSA (tax-free savings account) is a government-registered account that allows you to grow your savings tax-free. Some banks provide TFSAs that give a range of risks. Depending on what you and the financial institution decide is best for you, you could choose to set up a TFSA with a low risk and low rate of return or a mid-high risk and higher rate of return.

Source: TFSA: Top 10 questions and answers. (2019, January 30). National Bank. https://www.nbc.ca/personal/advice/savings-investment/10-clarifications-about-tfsas.html

Why might it be important to understand all the specific details of an investment before deciding to invest?

Investment risk and timelines

It is important to decide on a timeline when you are setting your financial goal and deciding on an investment.

Short-term goals are things you want soon, like art supplies or a game.

Mid-term goals are things you’ll need to save for a bit longer, like taking a special class or a fun outing with friends.

Long-term goals are things you want to have further in the future, like a car or post-secondary education.

Think

What kind of investment do you think would work best for each of the following types of goals? When you’re ready, press the show answer button to compare your thinking.

-

Short-term financial goals

For a short-term goal, an investment that has low risk may be a good choice. This allows you to make a bit of extra money through interest but keeps your money safe. Examples of low-risk investments include a GIC.

-

Mid-term financial goals

For a mid-term financial goal, an investment that is medium to high risk might work better. With time, the market can rise and fall which means that money can be earned and lost, but there is more time for an investment to grow. A mid- to high-risk investment could mean putting money into a bond or mutual fund.

-

Long-term financial goal

For a long-term financial goal, an investment that is high risk might work better. With time, the market can rise and fall which means that money can be earned and lost, but there is more time for an investment to grow. A high-risk investment could mean putting money into a stock.

Teacher Ravi says: Before making any type of investment, it is always important to consider the financial goal and do some research. This could mean speaking to a financial advisor or another type of financial planner and learning more about what works best for you.

Capital gains

Capital gains are profits (money) made from the sale of an investment or item that has increased in value over time. If an item increases in value and the owner sells that item, they make money. This money is referred to as a capital gain.

For example, if a person buys a house for $500,000 and sells it for $800,000, they will have capital gains of $300,000.

Consider this example: if someone purchases 10 shares of a company’s stock for $200 each, and four years later sells those shares for $400 each, they will have earned $2,000 in capital gains.

If an investor purchases a product, and the product loses value, then there are no capital gains. If the investor sells, they will lose money.

Why might it be important to understand how much capital gains are made on an investment?

Credit types

Credit is the ability to borrow money or access goods or services with the understanding that you'll pay it back at a later time, sometimes with interest.

Press the following tabs to learn more about the different types of credit.

A credit card is a plastic card that allows the cardholder to borrow money from their financial institution to pay for goods and services. Different credit cards have different credit limits (a maximum amount of money that can be borrowed). The borrowed amount must be paid back according to the rules set by the company.

If the credit card holder pays back the borrowed amount by the due date (typically the end of the month), they will not pay any extra fees. However, if they cannot pay the borrowed amount in full by the due date, then they will be charged interest (fees) on the unpaid amount. The amount of interest charged depends on the interest rate. An interest rate is usually a percentage of the amount that is owed. Credit cards usually have higher interest rates than other types of credit.

Some credit card companies provide cards that gather points or redeem rewards, but those cards may have special fees attached.

A line of credit is a type of loan that a financial institution agrees to lend you up to a pre-set amount. It’s like having a jar of money that you can borrow from when you need to. You may use as little or as much of the funds available up to that specific limit.

You can pay back the money you owe at any time, however, interest will be charged on top of the borrowed amount. And, unlike a credit card, if you take out some money, you start paying interest on what you borrowed right away.

Usually, the interest rate on a line of credit is lower than credit cards.

Some lines of credit require additional fees. For example, you may need to pay a registration fee.

Source: Financial Consumer Agency of Canada. (2025, March 28). Lines of credit. Canada.ca. https://www.canada.ca/en/financial-consumer-agency/services/loans/loans-lines-credit.html

Personal loans allow you to borrow a specific amount of money and pay it back over a set period of time.

You must pay back the full amount, including interest and any other fees, by making regular payments called installments.

Usually, the interest rate on a loan is lower than credit cards and lines of credit.

Did you know?

There are special credit options available for students in post-secondary education.

Student credit cards

Student credit cards allow people with little or no credit history to get approved while in school. They usually have lower credit limits, and do not require an annual (yearly) fee or a minimum annual income (amount someone makes yearly).

Student lines of credit

Students who are enrolled in a post-secondary institution may be eligible for a student line of credit to help pay for expenses like tuition and living costs. Student lines of credit typically offer lower interest rates than standard lines of credit and a more flexible repayment plan.

Student loans

In Canada, students who are continuing their education after high school may apply for a student loan called the Ontario Student Assistance Program (OSAP). Part of the loan is funded by the federal government and does not charge any interest. Another part of the loan is funded by the provincial government and may charge interest depending on the rules set by the province.

Simple and compound interest

Okay, so how does simple and compound interest factor in?

Simple interest is interest applied to the principal amount. Whether you are investing or borrowing, simple interest will grow on the principal amount only.

Compound interest is interest that is applied to the principal amount and interest along the way.

For savings and investments, compound interest helps you make more money at a faster rate. However, with debt (e.g., credit cards, loans) compound interest “compounds the interest” you owe and makes it more difficult to pay off.

Teacher Ravi’s investment options

Teacher Ravi is thinking of investing his money. He is considering three options:

- An investment that applies simple interest at a rate of 6% interest per year.

- An investment that applies compound interest at a rate of 6% per year, compounded semi-annually.

- An investment that applies compound interest at a rate of 6% per year, compounded semi-annually, and with the option to set up a recurring payment. This means that Ravi can add more money to the principal amount every year. He chooses to add $100/year.

He wants to see what $100 invested in each account gives him in three years.

Try it!

Let’s calculate what each option will give him in three years.

For each of Ravi’s three options, use the following Interest Calculators to figure out how much his investment would increase after three years. When you are finished, press the Show Answer button to compare your calculations.

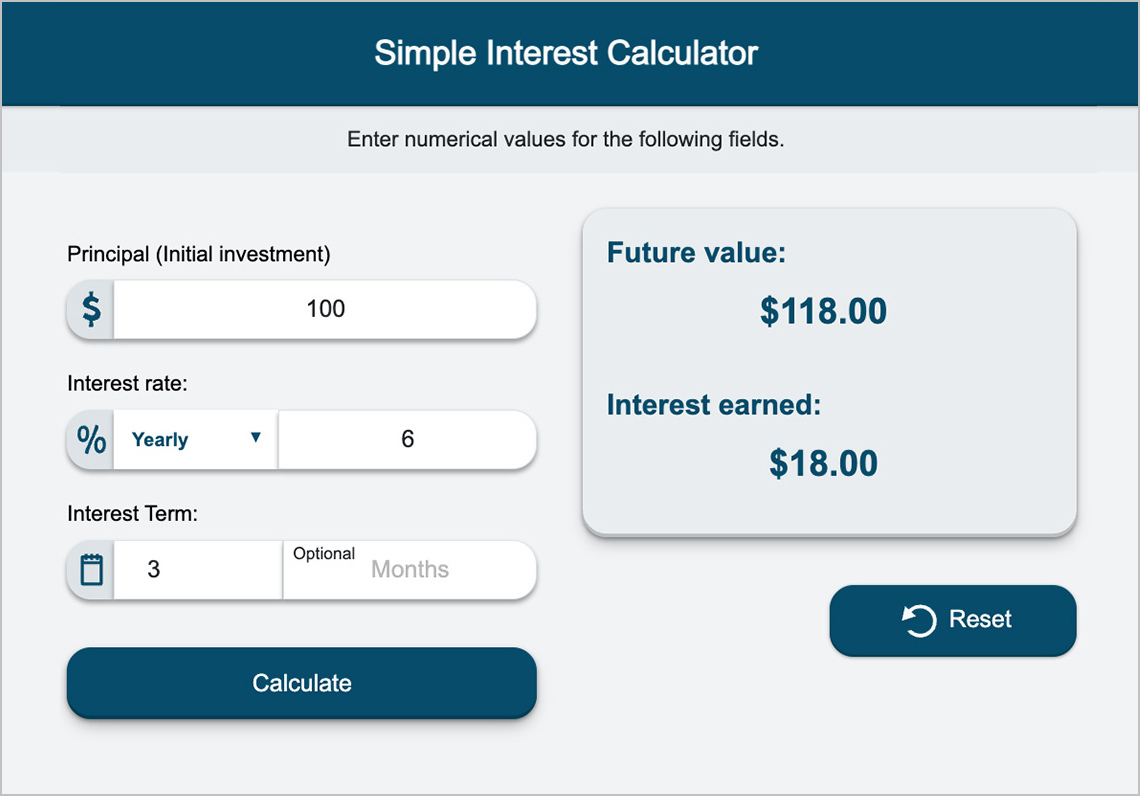

Option 1: $100 invested in an account that applies simple interest at a rate of 6% interest per year.

Teacher Ravi’s investment would increase to $118 after three years.

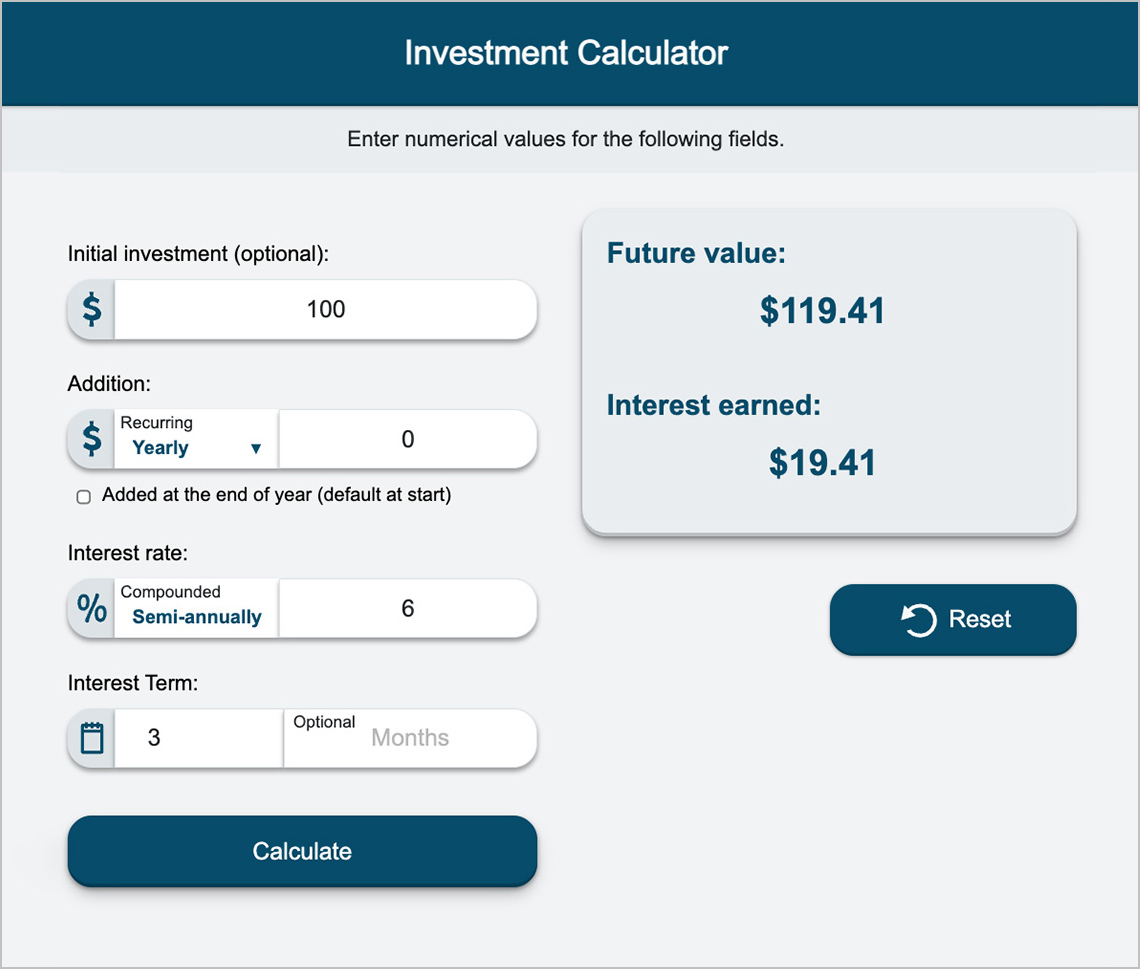

Option 2: $100 invested in an account that applies compound interest at a rate of 6% per, compounded semi-annually.

Answer: Teacher Ravi’s investment would increase to $119.41 after 3 years.

Formula: A = P(1 + i/n)t

A = 100(1 + 0.06/2)6

A = 100(1 + 0.03)6

A = 100(1.03)6

A = 100(1.1941)

A = 119.41

The interest earned is $19.41. The future value of the investment is $119.41

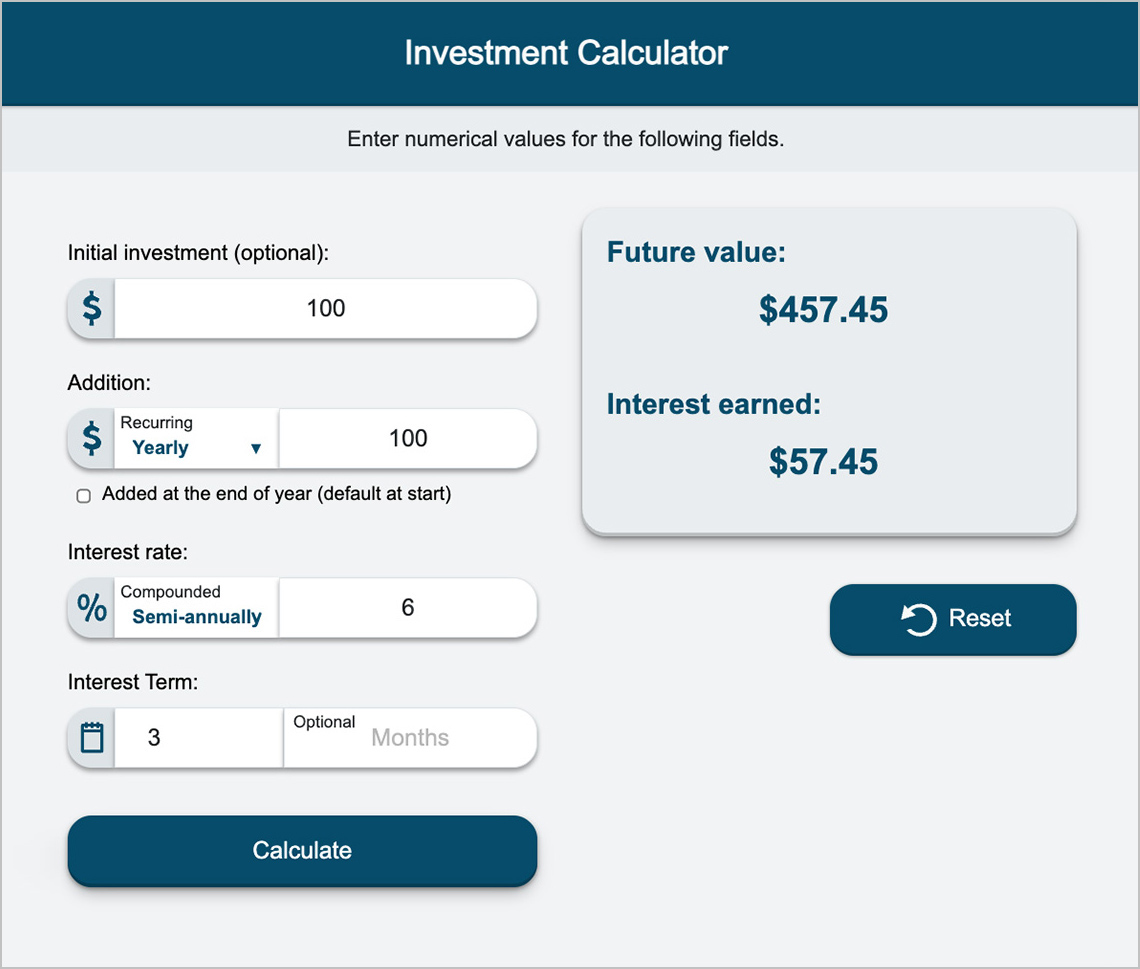

Option 3: $100 invested in an account that applies compound interest at a rate of 6% per year, compounded semi-annually, with a recurring payment of $100/year.

Answer: Teacher Ravi’s investment would increase to $457.45 after 3 years.

Let’s see what happens to Teacher Ravi’s investments over a 10-year period.

Explore the following line graph and table of data. What do you notice about each? Do you notice any patterns?

Why might a graph be an effective tool to track an investment?

| Time | Simple interest | Compound interest (compounded semi-annually) | Compound interest + (compounded semi-annually with a recurring payment of $100/year) |

|---|---|---|---|

| 1 year | $106 | $106.09 | $212.18 |

| 2 years | $112 | $112.55 | $331.19 |

| 3 years | $118 | $119.41 | $457.45 |

| 4 years | $124 | $126.68 | $591.40 |

| 5 years | $130 | $134.39 | $733.51 |

| 6 years | $136 | $142.58 | $884.27 |

| 7 years | $142 | $151.26 | $1,044.21 |

| 8 years | $148 | $160.47 | $1,213.89 |

| 9 years | $154 | $170.24 | $1,393.91 |

| 10 years | $160 | $180.61 | $1,584.89 |

Self check

Next, let’s check your understanding with the following matching activity. For each investment or credit term, select the corresponding definition.

Reflection

What are two or three takeaways about investments and credit that you would share with a friend?

What are some of the impacts of simple and compound interest on saving and borrowing?

How does time factor into an investment?

Record your answers using a method of your choice. Share your thoughts with a partner, if possible.