What Steps Can I Take to Create a Simple Budget?

Transferable skills

Curriculum expectations

F. Financial Literacy

F1.3 explain the concepts of spending, saving, earning, investing, and donating, and identify key factors to consider when making basic decisions related to each

F. Financial Literacy

F1.4 explain the relationship between spending and saving, and describe how spending and saving behaviors may differ from one person to another

F. Financial Literacy

F1.3 design sample basic budgets to manage finances for various earning and spending scenarios

F. Financial Literacy

F1.2 identify different types of financial goals, including earning and saving goals, and outline some key steps in achieving them

Introduction

We usually spend money on needs and/or wants. Our needs are the things we require to survive such as water, food, and shelter. Wants are the types of goods and services that we would like to make our lives easier.

So, where does a budget fit into all of this?

Understanding budgets

A budget is a plan that helps you manage exactly how much money you earn, how much money you spend, and how much money you save over a given amount of time like a week, a month, and/or a year. A budget helps us understand how we are spending our money on our needs and/or our wants.

Okay, so how could we get started?

Tracking expenses

Before we can create a budget, we need to learn to track. Tracking means recording how much money comes in and out of your hands. This helps us get a clear sense of our spending and saving habits.

There are many ways to track! Some might write out their budget on a piece of paper and use different colours to organize their information.

Some might use a spreadsheet or online tracking program. Tracking on a regular basis really helps us see what our spending and savings patterns are.

Once you have tracked your money and habits for a period of time, you might think it’s time to set some financial goals. That’s where a budget comes in.

Before we continue, let’s pause to consider some vocabulary terms connected to our learning.

Vocabulary terms

Press the following terms for their definitions.

Save means to put money aside for future use, instead of spending it right away.

Earn means to receive money in return for labour or services.

Expenses are any goods and/or services that you spend money on.

Income is money that you earn when working a part-time or full-time job.

A financial goal is a plan or an objective that a person sets that affects how they spend and save money. Objectives can be short term, such as buying a pair of sneakers, or long term, such as attending university.

Creating a budget that works for you

You can create a budget with any amount of money. It can be a little and it can be a lot. It could be for a short period of time, or it could be for a long period of time. The most important thing is thinking about how budgets work, and how money is used every day. Your budget can always change depending on what is happening in your life.

How much a person spends, when they spend, and what they spend on varies from person to person.

Enveloping or jam jarring

Jam jarring or enveloping is a budgeting method where you separate different amounts of money for expenses at the beginning of the month or week (e.g., groceries, bills, entertainment etc.). You can put the money in a physical jar, envelope, or a digital pot – some banks have the option to create a sub-account within your bank account. It’s a great way to see exactly where your money is going.

Marcel: I’ve been trying to track my spending so I can save up for some new clothes.

Sora: I find the best way to track for me is enveloping or jam jarring.

Marcel: I track everything in a spreadsheet, but I set reminders in my calendar so I don’t forget to do it.

Sora: I really like the idea of setting reminders. I’m going to try that myself!

Alright, so let’s get into it. What are some steps you can take to create a simple budget?

A step-by-step plan

Source: Eschner, K. (2023, Jan 24). How to make a budget (and actually stick to it). TVO Today. https://www.tvo.org/article/how-to-make-a-budget-and-actually-stick-to-it

Avery’s budget

Check out a sample budget that learner Avery created.

Avery’s monthly budget

Income

Part-time job earnings (piano teaching assistant) = $250

Babysitting = $40

Total income = $290

Expenses

Transportation (bus and transit pass) = $60

Phone bill = $40

Entertainment and Classes

Going out to restaurants and dining out = $50

Piano lessons (advanced) = $100

Total expenses = $250

End of Month Balance = $40

Self check

The following cards contain the steps you can take to create a simple budget. Put the items in each answer box in the correct order.

Neebin’s gardening business

Explore the following scenario. What advice would you give?

Neebin has been volunteering in her local community garden for a few years and loves being outdoors in the spring and summer. She talks to a few trusted neighbours and members of her community and realizes that a few of them are interested in having her plant a little garden for them or tend to their plants.

She decides to create a little gardening business.

She already has a spade and gardening gloves, and a great understanding of what plants need to grow.

What advice would you give Neebin to help her track and create her own budget for the business?

What might be most important for her to remember?

Press the Possible Advice button to access some sample answers.

- Create a goal for her business that suits her needs. This might mean deciding on how many clients she would like to take on and figuring out what kinds of gardening projects (simple or complex) she would like to do.

- Consider what she needs to buy for the business (e.g., seeds, additional gardening tools) and track how much she spends and earns with each gardening job.

- Create a savings goal for her business. Start small!

- Revisit her expenses, earnings, and savings goal regularly. If something is not working anymore, it’s okay to make a change!

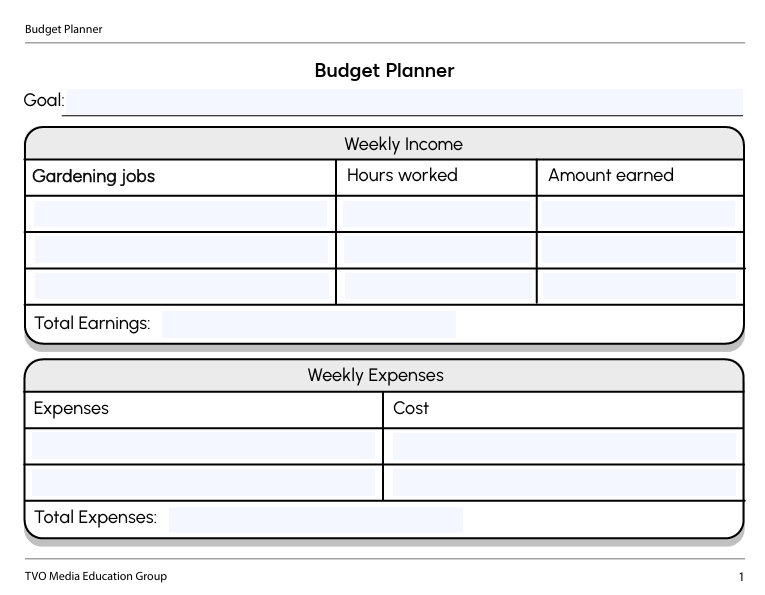

Neebin’s budget

Neebin is ready to track all of her information in a budget, but she’s unsure how to get started. Based on your learning, design a sample budget planner for Neebin. She can use it to get started. What is the main information that you would need to include?